|

How to Pick Stocks Using the Power of ProbabilitiesSPONSOR: As you know, a probability is the likelihood of a particular thing to occur. If you want to buy a stock that will likely rise or decline (for shorting), you need to line up as many probabilities in a stock candidate’s favor as you can without over complicating the strategy.

News would include company-based information including earnings, new products or services or management-related changes. It could also be economic or political news. The probability of a stock going up on good news may be higher than not, but that factor alone is not enough.

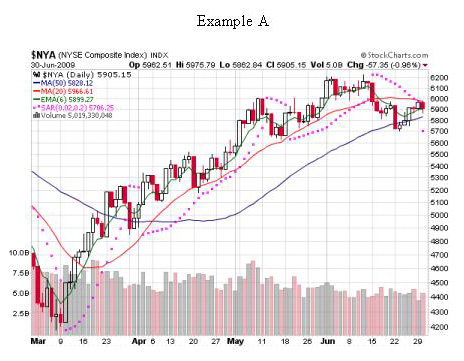

The general direction of the market will have an effect on how well your stock trades do for you. Before making a trade, you must know if the market is trending up or down or not trending at all. For example, you would probably want to go long in example A and short in example B.

For company fundamentals, a high probability factor could be increasing or decreasing earnings, sales, return on investment (ROI) or any other fundamental criteria that can have an impact on the stock price’s value. Theoretically, a company that’s a good value and has good earnings will rise in price. But that’s not always the case as other factors affect the price of a stock, and fundamentals alone should not be used.

News, market trend and fundamentals can be a part of your list of stock trading probabilities, but it shouldn’t be your only criteria. News and fundamentals alone can actually be more speculative than applying knowledge of technical indicators to recognize what is occurring with a stock’s price. Combining technicals with fundamentals can be an effective long-term strategy. However, consider that many mid-term holds for several months that are price “high achievers” may not have the strongest fundamentals so a choice has to be made. Do you want to hold a position in a fundamentally strong stock or a stock with strong price movement? Most probability discussions are associated with technical indicators and that’s what the rest of this discussion will be about.

There’s a theory called Efficient Market Hypothesis (EMH) that proposes a stock price reflects everything that is known and could possibly change the value of a stock’s price. In other words, all of the circumstances that can affect the value are exhibited by the current price. If that’s true, than studying fundamentals to conclude a stock’s value is redundant. If that’s also accurate, what’s left to interpret price direction? The answer is trader sentiment. For example, on paper, WTNY is an unimpressive stock. If you look at the fundamentals, they don’t look so great. A look at the competition in the industry group reveals that it is not the best in its group. It’s news hasn’t been overly compelling. So what would induce a non-volatile stock like WTNY to increase in value by 87% in 5 months?

A trader’s job then is to combine a technical indicator strategy to use as a factor of probability for how to pick stocks. The technical strategy has to be logical and as historically consistent as possible. Additionally, the potential strategy’s success has to be confirmed by back testing or paper trading it to see if it has some measure of being successful. All of the probabilities for how to pick stocks then come together to form a stock trading strategy. Some technical indicators are MACD, Stochastics, Bollinger Bands, moving average (MA), average directional index (ADX) and there are many more. Additionally, Japanese candlestick formations can give you probable pattern setups too and should be added to the list of probabilities. That’s the practical aspect of how to pick stocks using probabilities, but it’s not the end of the exercise. Be certain to spend a bit of time back testing the potential strategy. Ask yourself - did the strategy hold up over a larger percentage of found stocks? Or did it fail more than you’d like? No strategy is 100% accurate, but the higher the percentage, the better.

If the setup looks good, you take the trade. Go for it. It’s really the best you can do to pay attention to stocks that have set up the way you want. There is no patterm/setup that works every time. Get accustomed to seeing a setup fail so that you take immediate action to liquidate it, reevaluate the market and look for new candidates.

Now you understand the skill and intellect of how to pick stocks using probabilities! If you're ready, it's time to move on to a list of

stock trading strategies

and how they piece together to create a setup. |

Search Stock Trading Warrior

Learn about Options

Options are a solid weapon to have in your investing arsenal to hedge positions or manage risk. Learn from the 2019 U.S. Investing Champion, Trader Travis.

Stock Market Insights

Want a peek at DOW Jones Industrial Stocks that are beginning to trend?

Click HERE!

Learn Trend Trading!

Free Videos

Presented by 30year Market Veteran Adam Hewison

What really makes a stock price rise? To find out watch:

Stock Market Insights

How a Simple Line Can Improve Your Trading Success

"How to draw a trendline" is one of the first things people learn when they study technical analysis. Typically, they quickly move on to more advanced topics and too often discard this simplest of all technical tools. Read more...

a Trend?... Find Out Now!

Online Stock Brokers

Read the online brokerage discussion...